Units Of Production Method Formula

The terms - stock-still assets or asset depreciation could intimidate y'all at times, specially if you are yet to learn the concepts of accounting or take come across them later on a long time. Knowledge about these terms is essential for your business. Fixed or tangible assets that the organizations acquire deteriorate later a time. The companies calculate the value of the deteriorated asset as this value is reflected in the accounts.

While tangible avails are depreciated, intangible assets are amortized.

This article focuses on the Unit of Production method of depreciation.

Lot more in this mail service:

- What is depreciation, its types, and why you should calculate information technology

- Formula and calculation using Unit of Product method

- Example of the unit of production method

- Facts to know about the Unit of Product method

- Advantages and Disadvantages of the method

- Its effect on bookkeeping

What is Depreciation?

Depreciation is a method to calculate the subtract in value of the physical asset over its useful years. In unproblematic terms, companies utilize depreciation to empathize how much the value of their asset decreased over the years of its useful life. Every nugget deteriorates due to continuous use or due to obsolescence. Sometimes, the companies may determine the number of years for which they volition use the nugget.

What are the Types of Depreciation?

Most companies opt for i of the 4 methods of depreciation stated below:

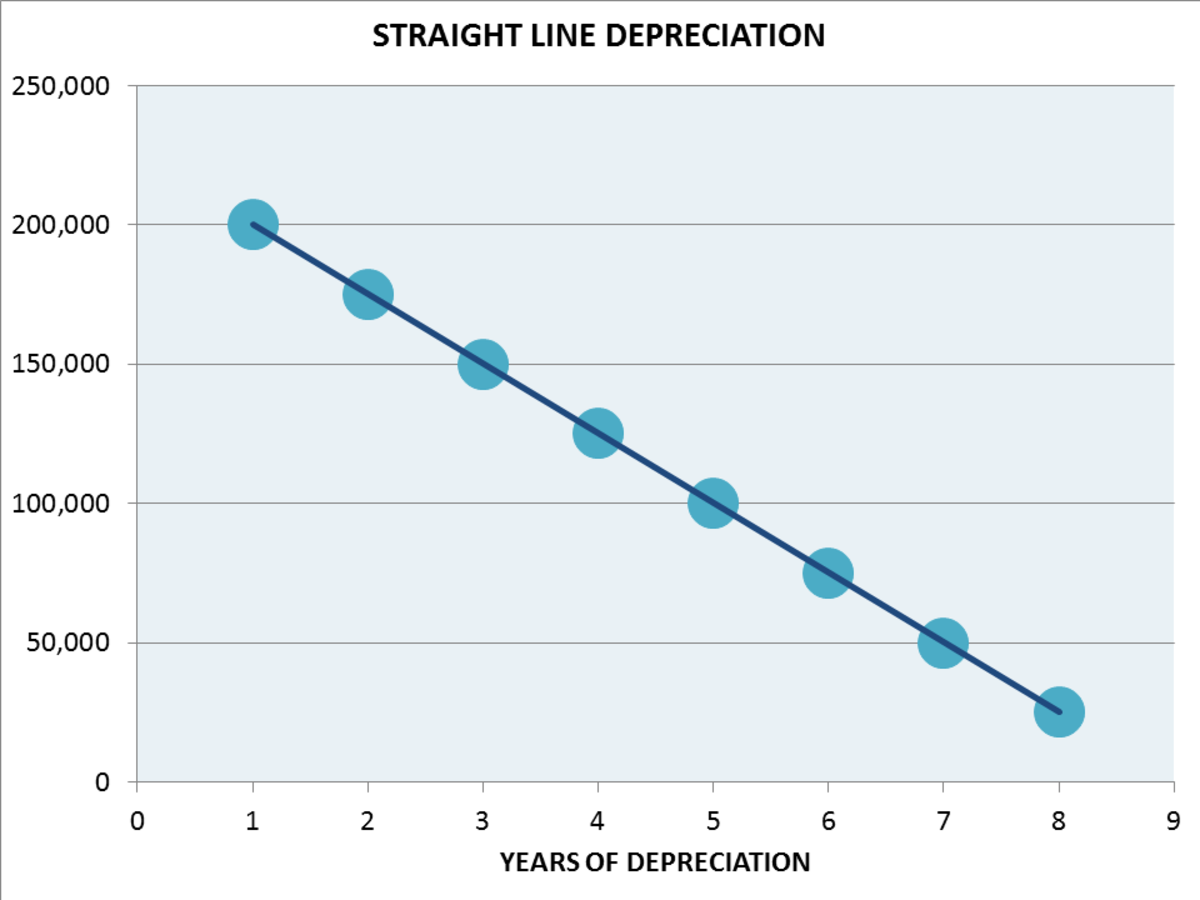

Straight-Line Method

The straight-line method is the default method that considers an even value for depreciating the asset over its useful life. The resultant divergence of asset price and salvage value is divided by the number of useful years of the asset.

This method calculates depreciation through this expression:

| Straight-line depreciation Expense = | Toll of Nugget - Salvage Value |

| Useful Life of an Asset |

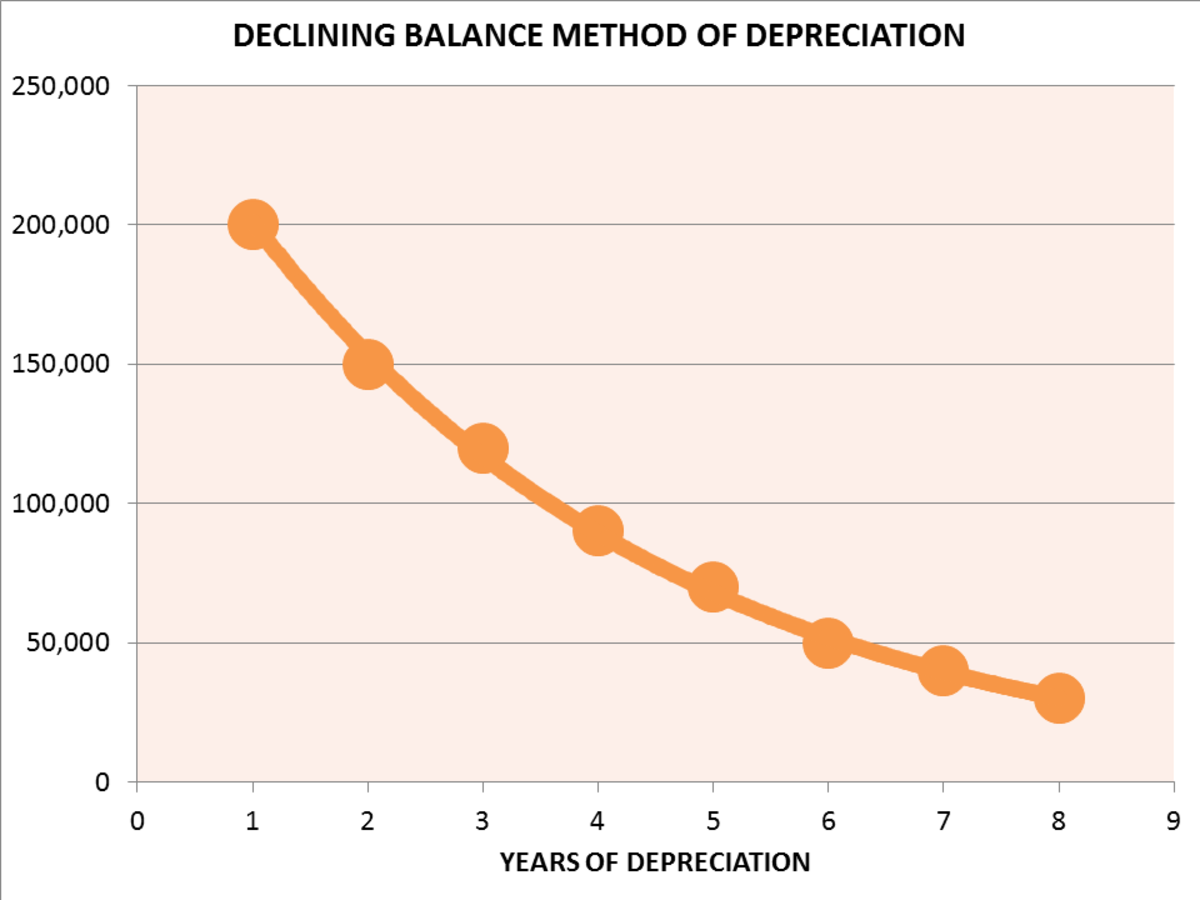

Failing Balance Method

This method is an accelerated method of calculating depreciation. It is a system that records larger expenses during the initial years of the nugget's useful life and smaller in the subsequently years.

This is its formula:

| Declining Residue method = | Price of Asset - Rate of Depreciation |

| 100 |

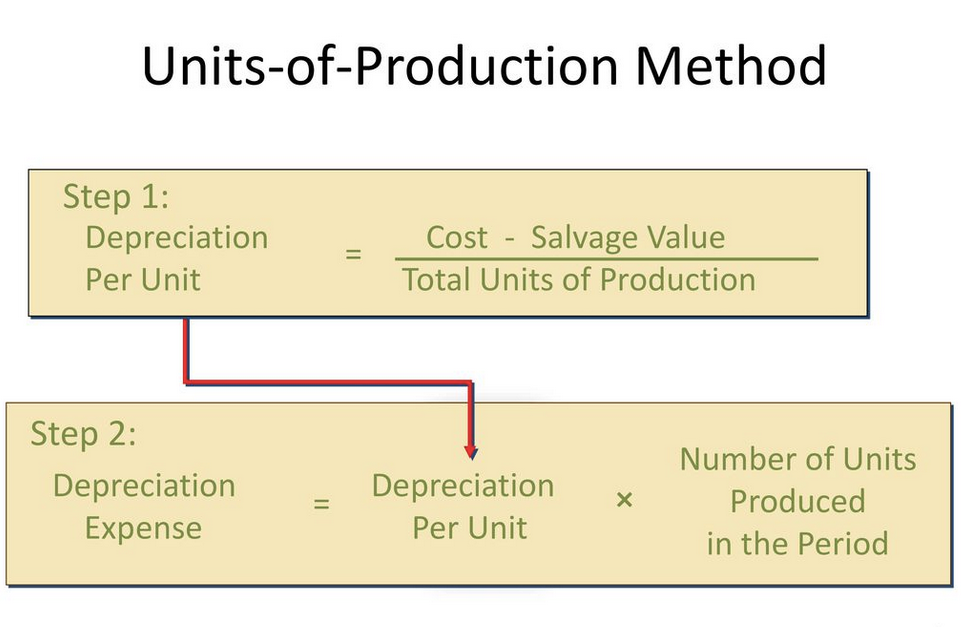

Unit of Product Method

This method calculates the depreciation for the asset when the asset's value is closely related to the number of units produced instead of the number of useful years.

Here's the formula:

| Unit of Product method = | Cost of Nugget - Salvage Value |

| Useful Life in the course of Unit Produced |

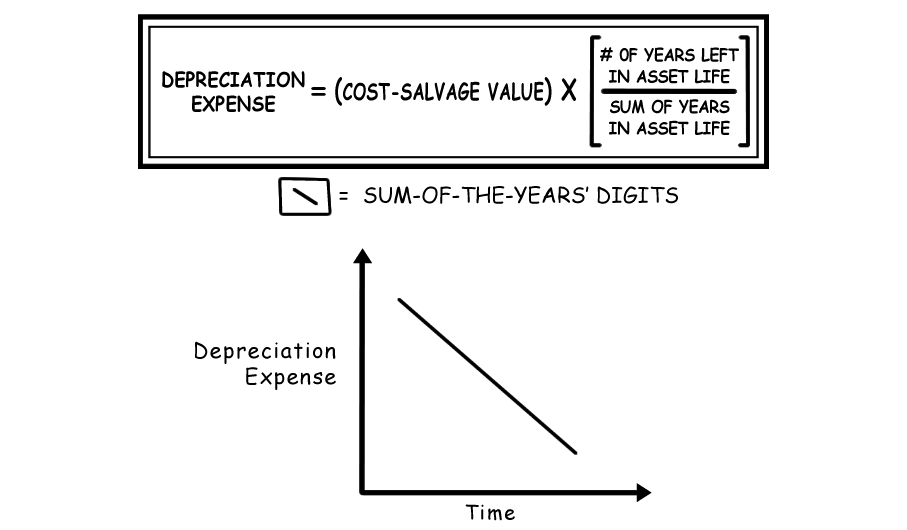

Sum-of-Year's Digits Depreciation Method

While this is as well an accelerated method, it is not every bit quick every bit the double failing balance method. Companies choose to go with this method every bit it facilitates larger depreciation revenue enhancement benefits in the initial years of the nugget'due south useful life.

This is the formula:

| Sum-of-Years' method = | Depreciation Toll x | Remaining Useful Life |

| Sum of the years' Digits |

3 Reasons Why You Must Calculate Asset Depreciation

Calculating depreciation is integral to your business. Without doing then could lead to a disastrous impact on the accounts of the concern. Here are the top 3 reasons why you lot must summate asset depreciation.

Prevent Distorted Values

Not calculating depreciation will go on you away from realizing the actual value of the asset at that time. The asset could be inaccurately recorded in the account books. An over-recorded value will prove higher profits and hide the incurred losses. Moreover, the profit uncertainty could mislead the prospective investors and volition eventually impede the overall business organisation performance. A miscalculated profit and subconscious loss will affect the health of the business.

Avert Tax Problem

If you miss out on computing depreciation, you lot may have to face a college revenue enhancement corporeality because of an overstated profit. Also, at that place could exist erroneous capital expenses. While a small error may be fixed easily, a bigger departure in tax return calculation may invite formal investigations from the tax section. Re-auditing the amount of tax return can injure the credibility of your company.

Assess Utilization Menses Accurately:

Information technology is essential to appraise the utilization period of an asset, and depreciation helps you lot to know that precisely. This likewise lets yous know when to supervene upon the avails and augment the useful life. This will help dispose or supersede the avails which take deteriorated and lost productivity. This will in turn lead you to gear up an advisable upkeep for your concern operations.

What Is the Unit of Production Method?

The unit of measurement of production method is a manner to calculate depreciation of an asset in cases when the asset'due south value is related to the number of units it produced instead of the number of years it was useful.

This method offers greater deductions for depreciation in the fourth dimension when the motorcar/ nugget was heavily used, offsetting the periods when it will not exist much in utilise.

It is a method that is completely dissimilar from the duration-based measurements of depreciation like the directly-line and double declining balance method.

Realistically, the depreciation expense shown using this method considers the percentage of the asset'south capacity that was used upwards for that twelvemonth. Depreciation not only helps companies to depreciate assets but likewise helps in tax deductions. College deductions in the productive years enable the companies to attain a residue for the college production costs.

The Formula for the Units of Production Method

In the unit of production method, the depreciation expense is calculated by the formula below:

| Depreciation Expense = | (Original Value - Salve Value) | 10 Units per Twelvemonth |

| Estimated Production Chapters |

Here, estimated production capacity is the capacity of the asset to produce units. 'Units per twelvemonth' is the number of units produced by the nugget per year.

Examples of Unit of Production Method

This section highlights some examples where the unit of production is used for calculating depreciation expense.

Example 1: Sewing Car

Permit'south see this tabular array relevant to the sewing machine every bit the depreciable asset.

| Nugget | Based Price | Salvage Value | Useful Life | Estimated Units Produced in useful life | Actual Units produced for the period |

| Sewing Machine | $9,000 | $900 | 7 years | 100,000 | 20,000 |

These are the values we shall use in the calculation of depreciation using the Unit of Product method.

Step ane: Computing Rate of Unit of Product for sewing car

| Unit of production charge per unit = | Cost of Asset - Salvage Value |

| Estimated units produced |

| Unit of production rate = | 9,000 - 900 |

| 100,000 |

| Unit of Production Rate = 0.081 |

Step two: Calculating Automobile's Depreciation Expense

| Depreciation for twelvemonth 1 = Unit of Product Rate x Bodily Units Produced |

| Depreciation for year ane = 0.081 x 20,000 |

| Depreciation for yr 1 = $1,620 |

So, the depreciation expense for the start year of employ of the sewing auto is $ane,620.

Instance two: Crude Oil Institute

A processing plant of crude oil is estimated to produce 60 million barrels of crude oil in its useful life. The balance value of the plant is $2 million. The base of operations price of the plant is $15 one thousand thousand. The actual units produced in the 1st year of its operations are three 1000000 barrels.

Using these figures, the depreciation is calculated as follows:

Depreciation Expense = (fifteen - 3) x 2 / 60

= 0.4 million

So, the depreciation expense for the processing plant is $0.4 one thousand thousand.

Things You Should Know About Units of Production Method

The unit of product method is an atypical method that is unlike straight-line or other time-based methods for calculating depreciation. Here are certain facts that help u.s.a. know about information technology ameliorate.

- The unit of measurement of product method is considered most accurate when the avails produce units. Through this, the company can keep a tab on the profits and losses with precision. In cases where the assets produce units, a chronology-based method would non work as accurately.

- Besides, the unit of production method considers depreciating an asset when the asset starts producing units. The process completes only when either the machine's toll has been covered fully or if information technology has produced all the units information technology was meant to.

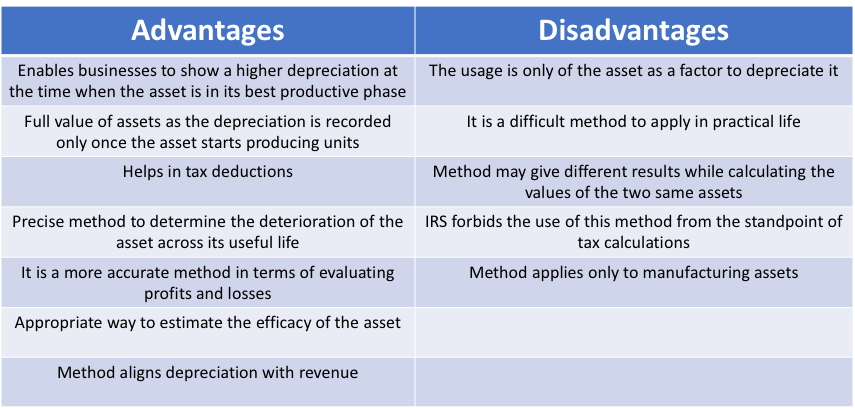

Advantages of Unit of measurement of Production

Let's first wait at the advantages of the unit of production method:

- The method enables businesses to evidence a higher depreciation at the fourth dimension when the nugget is in its best productive phase.

- The method makes apply of the total value of assets as the depreciation is recorded only once the asset starts producing units.

- It helps in tax deductions. Higher the depreciation expense in the fruitful or productive years, higher the chances of countering costs of production; thereby, aiding in higher acquirement in the productive years.

- It is a more accurate method in terms of evaluating profits and losses.

- It is a precise method to make up one's mind the deterioration of the nugget across its useful life.

- Information technology is a more advisable way to estimate the efficacy of the asset.

- The method aligns depreciation with revenue.

Disadvantages of Unit of Production

The disadvantages of the unit of production method are:

- The primary disadvantage is that the method considers only the usage of the asset as a gene to depreciate it; while there could exist numerous other means in which the nugget value drops.

- It is a difficult method to utilize in practical life. This is so because, in reality, there are various machines and assets that a company uses to build a product/unit of measurement. Measuring the value of each such asset would prove to be a tiresome and uphill task.

- The method may give different results while computing the values of the two same assets. Such confusion is non a good signal for whatever business.

- The IRS forbids the utilise of this method from the standpoint of tax calculations.

- The method applies only to manufacturing avails and not for avails like article of furniture, building, or trading companies.

When and When Not to Use Unit of measurement of Production

When to use: The unit of production method is best suited for manufacturing companies. The companies which involve machinery or equipment for the product of products or units, use this method.

Such companies require to see through the profit and loss movie clearly which the method presents them with. Having an accurate chart of these figures, the companies can get a improve grip over their business concern which caters to a market of fluctuating need.

When not to apply: The IRS prohibits the use of the unit of measurement of production method for revenue enhancement purposes and therefore, it may be somewhen used only for internal accountancy. The companies may use MACRS (Modified Accelerated Cost Recovery System) at the fourth dimension of revenue enhancement proceedings.

At this stage, knowing about Section 179 may prove beneficial as it empowers businesses to minus the total price of the asset up to a 1000000 dollars in the year it was purchased.

How Does the Unit of Production Method Affect Accounting?

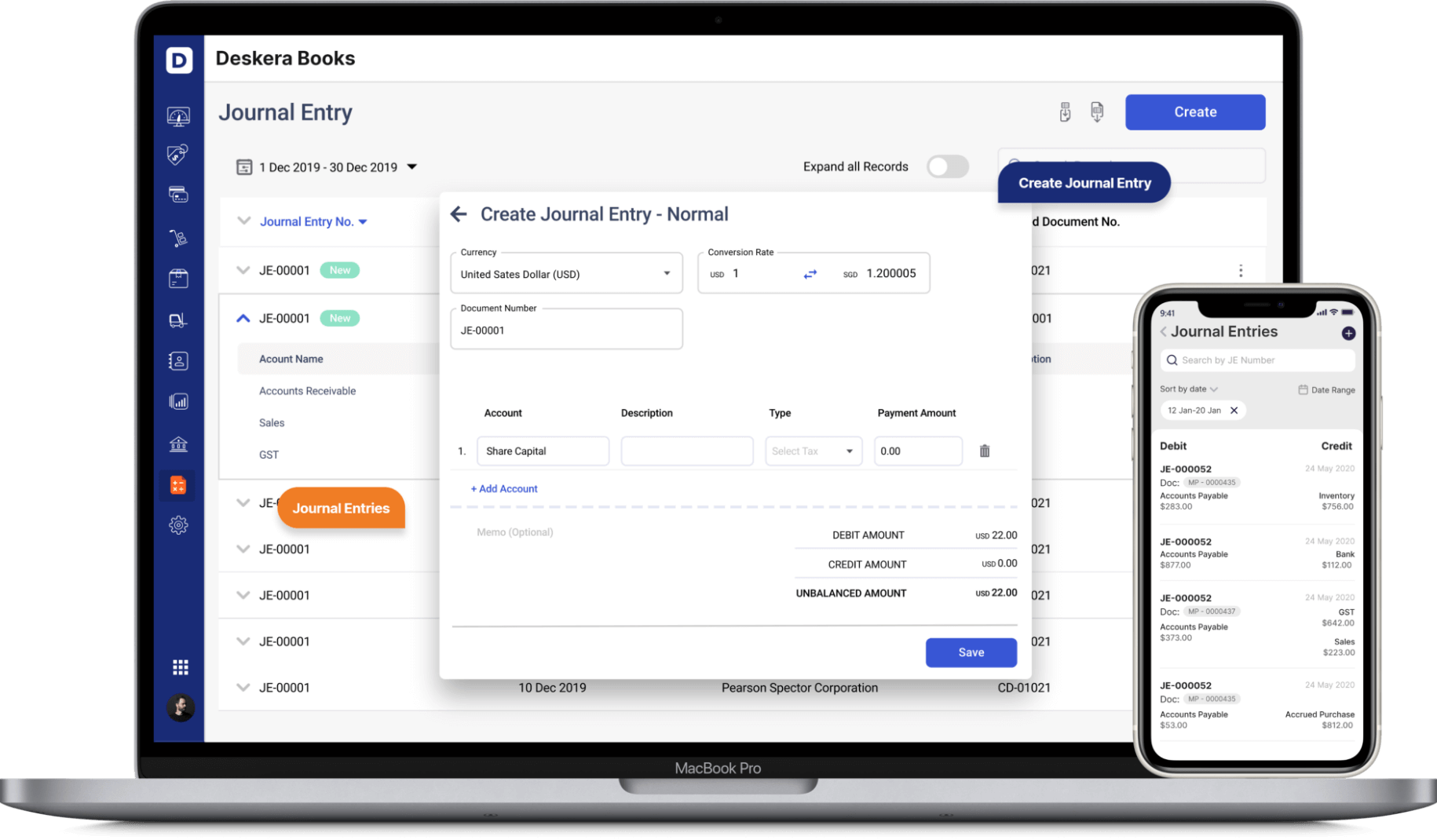

For financial bookkeeping purposes, businesses demand to maintain records of each nugget. They too require to prepare a journal entry and set a depreciation schedule to closely look at the tax expenses.

Nosotros discuss the 3 steps for recording the depreciation expenses calculated through the unit of product method.

Fix Depreciation Expense Journal Entry

A journal entry records depreciation expense and accumulated depreciation in the best possible manner. Information technology begins with debit depreciation expense. This increases the overall expenses in the profit and loss statement.

Side by side comes the credit to accumulated depreciation on the residue sail. It reduces the net value of all tangible avails.

A typical journal entry for a machine may look like this:

| | Debit | Credit |

| Depreciation Expense | $700 | |

| Accumulated Depreciation | | $700 |

Maintaining Records

Keeping a tab of all receipts, contracts, or any other important deeds or papers to testify the ownership over the assets is essential. These papers must include the engagement of purchase and the cost of the asset.

Each of the avails owned will have these related documents and the businesses demand to ensure that they keep a rails of these papers. These are likewise required when there is an inspect or a review.

Although, information technology should be remembered that this method volition not exist used for tax purposes and the company will have to apply other methods for that. However, IRS may inquire for supporting documents regarding avails and these receipts and papers should be presented at that time.

Preparation of Depreciation Schedule

The 3rd step involves creating a depreciation schedule that volition help monitor all assets. Using the unit of measurement of production method for bookkeeping purposes and MACRS for tax purposes tin ease the creation of a depreciation schedule.

A typical example of a depreciation schedule with the required information looks like this:

| Date | Clarification | Cost | Recovery fourth dimension (Years) | Depreciation Year ane (Books) | Depreciation (Tax) |

| Jan one, 2020 | Crane | $v,000 | vii | $400 | $300 |

| Jan 1, 2020 | Equipment | $9,000 | vii | $560 | $350 |

How tin can Deskera help your Accounting and Business?

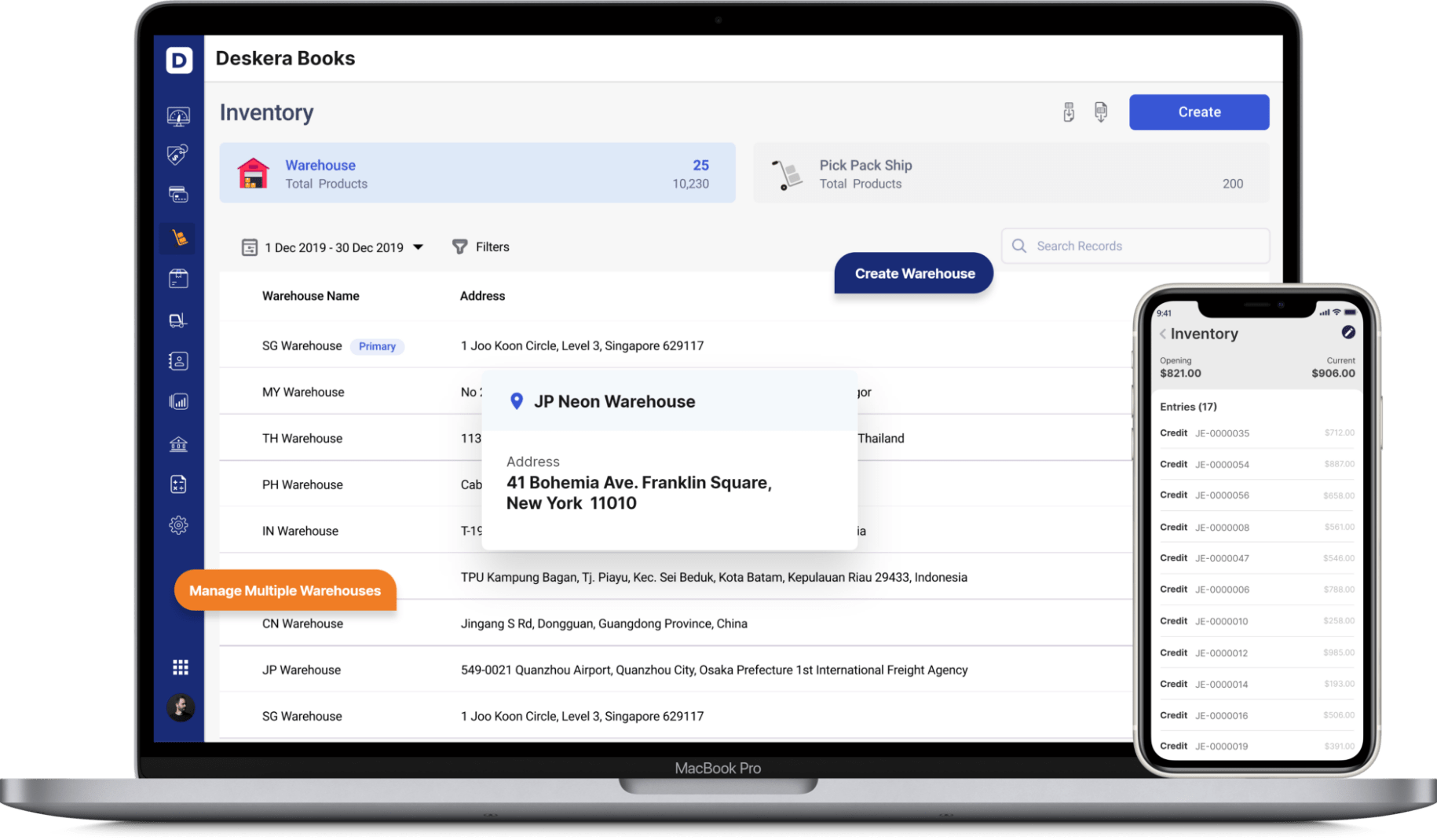

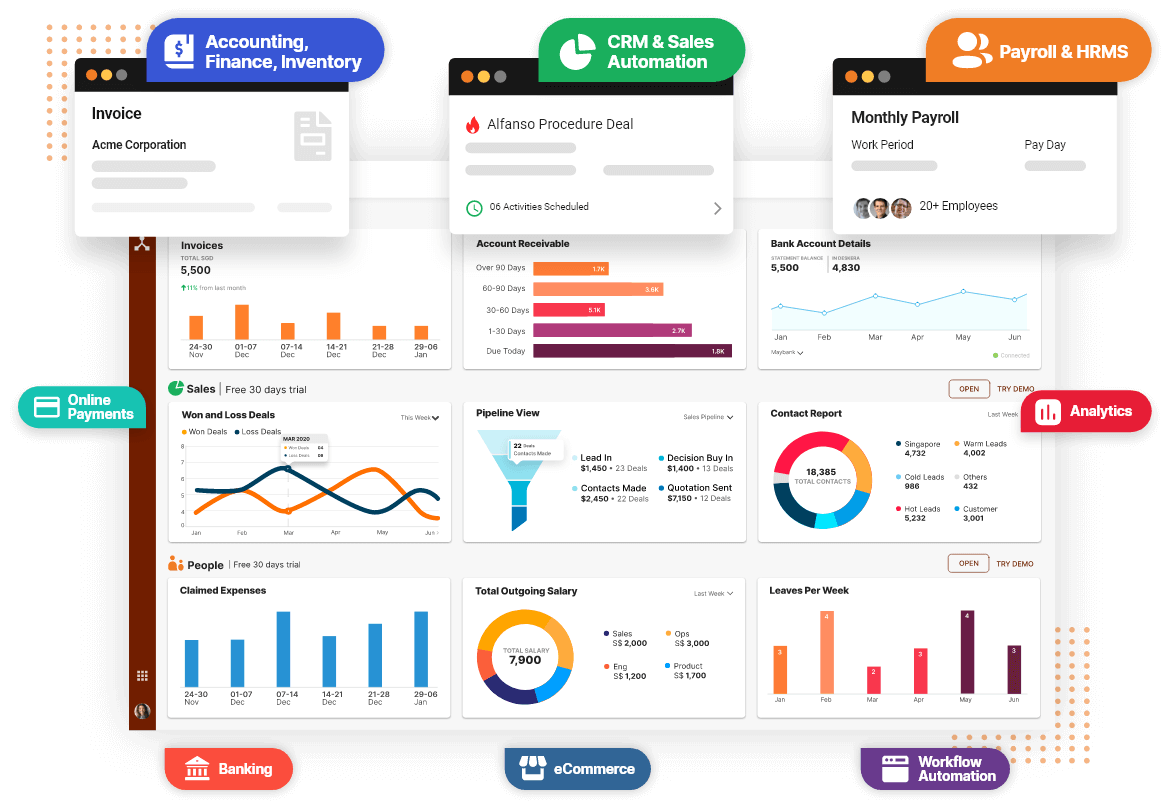

As a concern owner, you lot can invest in accounting softwares that tin can help you keep runway of your depreciating assets, scrape value, residual value, salvage value, periodical entries, balance canvass, inventory and production costs. A successful business needs an efficient financing process that meets its specific needs.

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and salvage fourth dimension. The double-entry tape will exist auto-populated for each sale and buy business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically menses to corresponding fiscal reports.

You tin take admission to Deskera'south ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

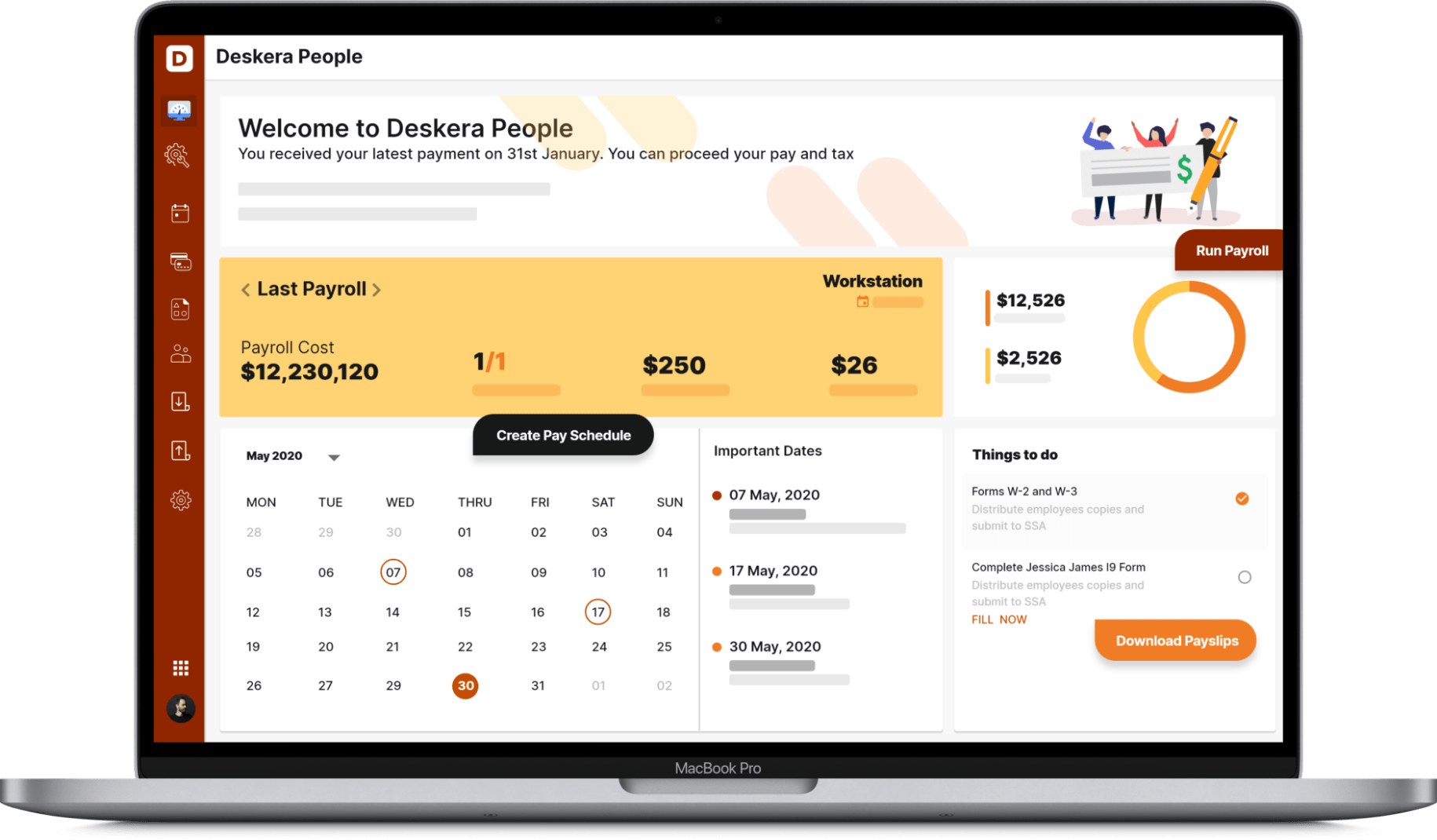

Deskera can besides help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera tin help you lot generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

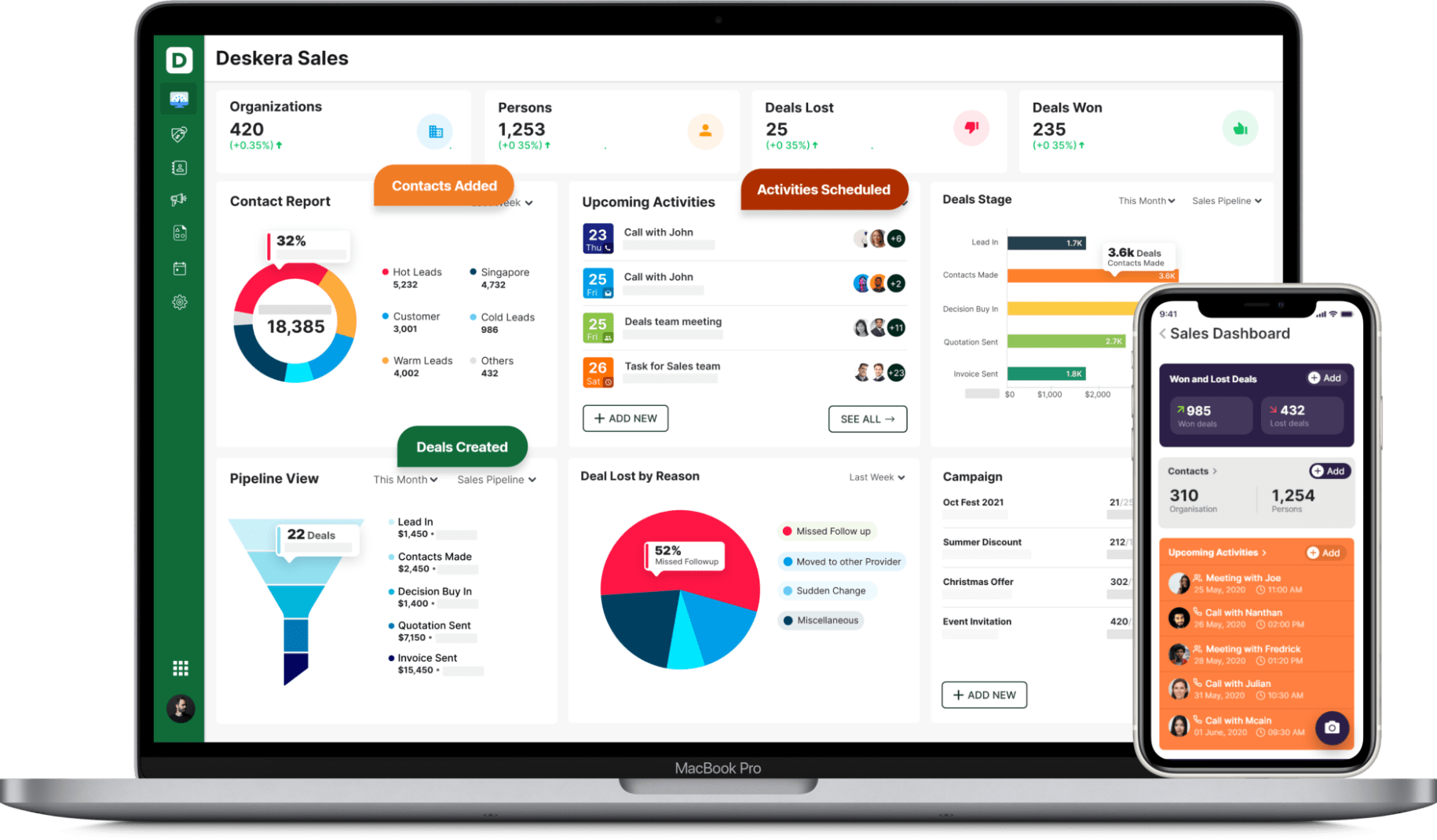

With Deksera CRM you tin manage contact and deal direction, sales pipelines, electronic mail campaigns, client back up, etc. Yous can manage both sales and support from one single platform. You tin can generate leads for your business concern by creating electronic mail campaigns and view performance with detailed analytics on open up rates and click-through rates (CTR).

Deskera is an all-in-i software that can overall assistance with your business to bring in more than leads, manage customers and generate more revenue.

Fundamental Takeaways

Based on the detailed description of the unit of measurement of production method, we take home the following points:

- The unit of production method considers the asset's practical usage in the process of production rather than because the years it was in use.

- This technique is more than applicable in cases where the machines undergo a college deterioration while they were used for production.

- Information technology also enables companies to bear witness more depreciation in the productive years and offset the increased costs of production.

- Practically, the depreciation expense shown using this method considers the percent of the asset's chapters that was utilized for that year.

- The unit of production method is best suited for the manufacturing companies involved in the production of units.

- The unit of production volition non exist allowed by IRS for taxation purposes. The businesses will have to use other methods like the MACRS for the same.

Related Articles

Getting Started with Deskera Books

Welcome & give thanks you for signing upwards and joining 500,000+ users worldwide in usingDeskera. In this guide, we accept compiled resources and steps to quickly get your DeskeraBooks business relationship up and running. Read on to learn about: * Setting upwardly your organization * Inviting your colleagues and accountan…

Understanding FNS (Fast, Slow, Not-Moving) Inventory Analysis

Exist it a retail business, wholesale, or whatsoever business that deals with inventory,inventory control or inventory management are crucial practices that help drivethe profit of a visitor. A contempo study suggests that companies tin reap a 25%increase in productivity, a twenty% gain in space usage, and a xxx%…

What is Inventory Reorder Point in Inventory Management?

"How much raw material should I guild from my supplier?" "When should I place my side by side supply order?" Yes, nosotros know that these are the top two questions yous ever have to askyourself every bit a business owner. Nosotros besides know that these questions aren't like shooting fish in a barrel toanswer too. Hence, today with this art…

What is Inventory Shrinkage and 7 Ways to Reduce Information technology

Running an inventory centric business is a hefty job. Managing inventoryshrinkage is important to reduce inventory costs and ameliorate margins. What is an Inventory? Inventory [https://www.deskera.com/blog/what-is-inventory] is the goods that abusiness source or produces with a vision to sell in…

Units Of Production Method Formula,

Source: https://www.deskera.com/blog/unit-of-production-method/

Posted by: hunterpubleausing.blogspot.com

0 Response to "Units Of Production Method Formula"

Post a Comment